Inherited ira rmd calculator vanguard

Additional comments in the discussion page tab at top. If youd like more control over your asset allocation consider a two-fund portfolio.

Vanguard Rmd Calculator Fill Online Printable Fillable Blank Pdffiller

The RMD rules apply to all employer sponsored retirement plans including.

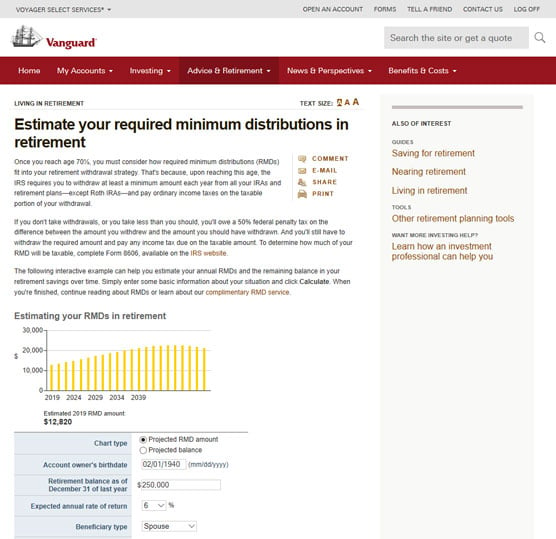

. Use our Beneficiary RMD calculator This tax information. The RMD Required Minimum Distribution calculators should be checked against the IRS Life Expectancy Tables to be sure that the appropriate table is to be used in your situation. If youll soon need to take an RMD from your IRA or small business retirement account and you have questions youve come to the right place.

If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD. The RMD rules also apply to Roth 401k accounts. Required Minimum Distribution RMD Calculator - MainStay.

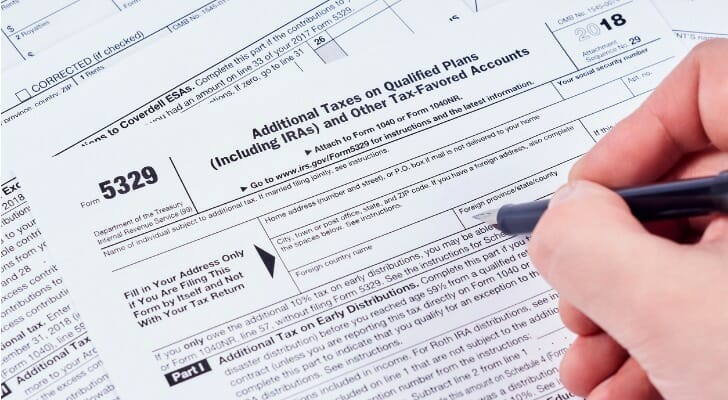

When you inherit an IRA as a non-spouse beneficiary the account works much like a typical IRA with three important exceptions. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs SARSEPs and SIMPLE IRAs. However Americans who turned 705 years old in 2019 will still need to withdraw their required minimum distributions this year and failure to do so results in a 50 penalty of their RMD according to Jamie Hopkins the director of retirement research at wealth.

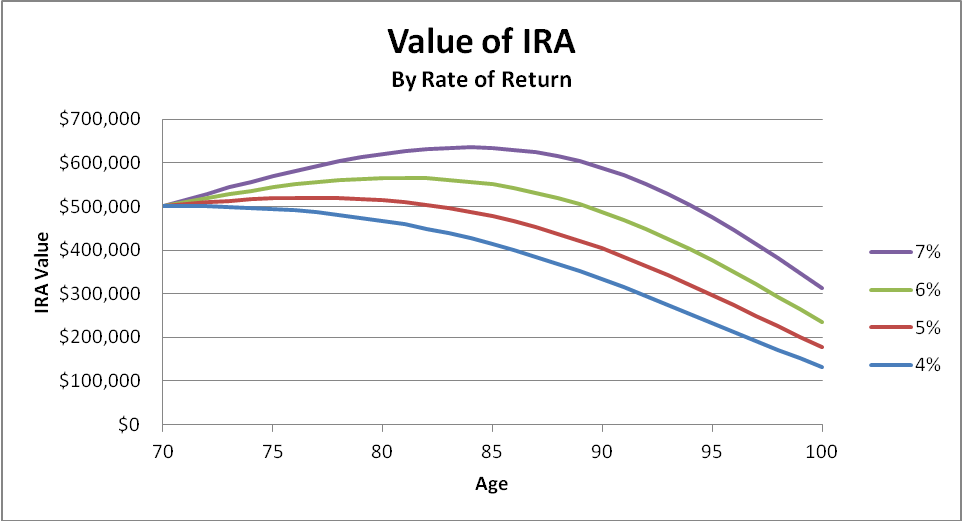

A workplace 401k plan helps you save a substantial amount each year for retirement but there are annual limits on contributions by you and your employer. This RMD waiver applies to any age and also inherited IRAs which help save on taxes. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs.

The 2-Fund Portfolio. If the 10-year rule is being used for your inherited account you should consult your tax advisor if you have any questions about. My annual plan has been saving 250000 per year in our after tax Vanguard mutual fund accounts AFTER fully funding my 401K HSA 529s and backdoor Roth IRAs.

Profit-sharing plans 401k plans 403b plans and 457b plans. RMD Required Minimum Distribution calculators. Call us at 866-855-5636.

With the first quarter stock market loss due to the corona virus many portfolios are down and allowing the RMD free pass in 2020 helps retirees avoid locking in losses to get access to cash to pay for their required minimum distributions RMDs. This tax information is not intended to be a substitute for specific individualized tax legal or investment planning advice. This video and the resources available on this page provide answers to the most common RMD questions that we receive at Vanguard.

Const FP featured_posts_noncea8acac3c40featured_postsdescriptionWith Bidens announcement of student loan cancellation many eligible borrowers are requesting. For an inherited IRA received from a decedent who passed away after December 31 2019. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more.

With this key job benefit your employer adds to the money you save boosting your 401k account over the long term. A 401k match is money your employer contributes to your 401k. Taking Your RMD at Vanguard Transcript.

I have a wonderful wife and two beautiful daughters. With just two well-diversified index funds you can create an excellent investment. This is the same as for a spouse beneficiary Withdrawals from.

Open an Inherited IRA. We live comfortably and have more than our basic needs met but live well below our means. No 10 Penalty Distributions from the account are not subject to the 10 penalty regardless of your age.

Cash in the IRA Within 10 Years. Whether you choose a traditional 401k. You will pay taxes on the amount of the distribution but no 10 IRA early-withdrawal penalty taxIf you choose this option you must cash in the entire inherited IRA by December 31 of the 10th year following the original IRA owners death.

You transfer the assets into an Inherited IRA held in your name. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Vanguards RMD Service doesnt accommodate accounts that are being distributed according to the 5 or 10-year rules.

As the first and largest cryptocurrency IRA company Bitcoin IRA takes our top spot as the best overall due to its easy account setup 247 real-time trading and advanced security features. You always have the option of cashing in an inherited IRA. The age to begin RMDs was increased from 705 to age 72 beginning in 2020.

Inherited Ira Rmd Calculator Td Ameritrade

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard

Inherited Ira Rmd Calculator Powered By Ss Amp C

Required Minimum Distributions Rmds Youtube

How To Take Money Out Of Your Ira Dummies

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Retirement Cash Flow From Ira Rmds Seeking Alpha

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Where Are Those New Rmd Tables For 2022

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Irs Wants To Change The Inherited Ira Distribution Rules

Congressional Bill Could Bring Rmd Age Hikes Retirement Aid For Student Borrowers

What To Do If You Miss Your Rmd Deadline Smartasset

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer