Iras tax calculator

Our Resources Can Help You Decide Between Taxable Vs. For comparison purposes Roth IRA and regular.

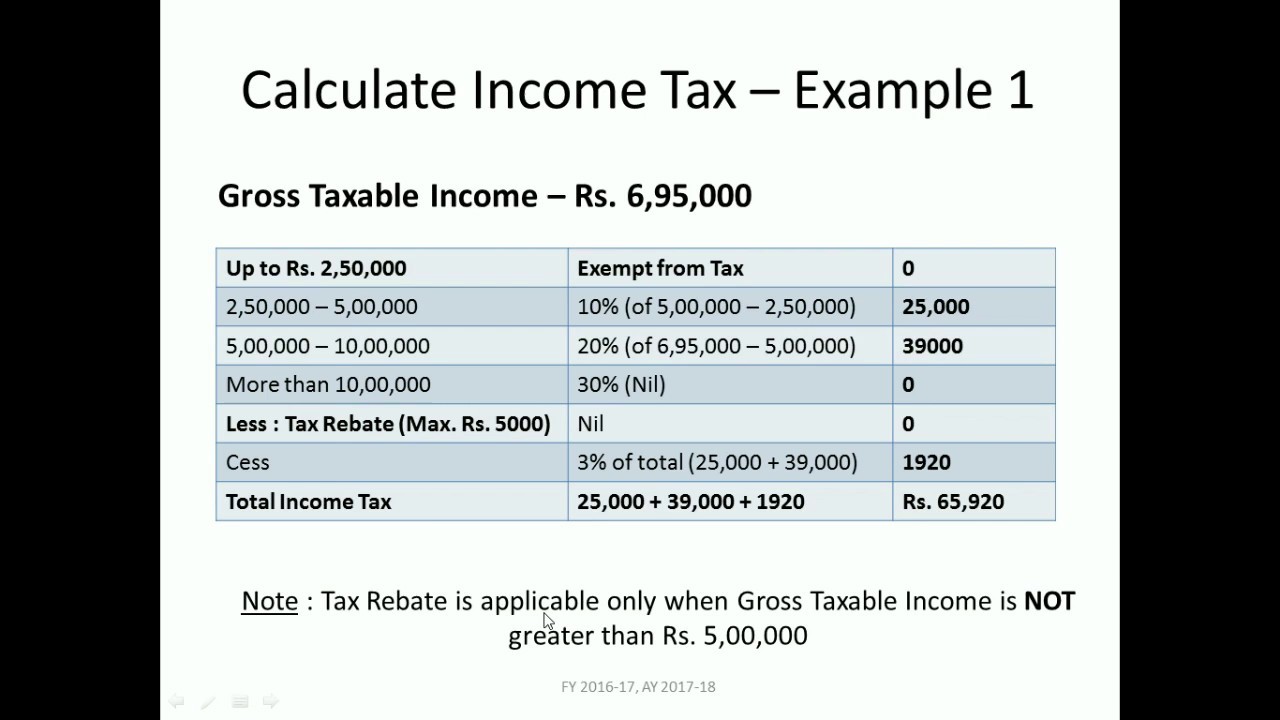

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

. Property Tax Calculator. This application is a service of the Singapore. You can determine potential.

See your tax refund estimate. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Even if you have access to an employer-sponsored retirement plan you may still be eligible to supplement your employers plan by contributing to a tax-deductible IRA or a Roth IRA.

If youve already paid more than what you will owe in taxes youll likely receive a refund. With Merrill Explore 7 Priorities That May Matter Most To You. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

You have nonresident alien status. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Well calculate the difference on what you owe and what youve paid. Use our IRA calculators to get the IRA numbers you need. Ad What Are Your Priorities.

PTR Calculator XLSM 52KB Documents Tax calculator_Residents_YA22 XLS 131KB Documents Tax Calculator for Non-Resident Individuals XLS 95KB Pages What is taxable. Account balance as of December 31 2021. Estimate your tax withholding with the new Form W-4P.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Safari on iPhoneiPad iOS 9 and above.

While long-term savings in a Roth IRA may produce better after-tax returns a. Your life expectancy factor is taken from the IRS. Ad What Are Your Priorities.

Unfortunately there are limits to how much you can save in an IRA. How is my RMD calculated. Roth IRA contributions on the other hand are not tax deductible although qualified withdrawals of both contributions and earnings from a Roth IRA are free of federal income tax.

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free. Ad Visit Fidelity for Retirement Planning Education and Tools. With Merrill Explore 7 Priorities That May Matter Most To You.

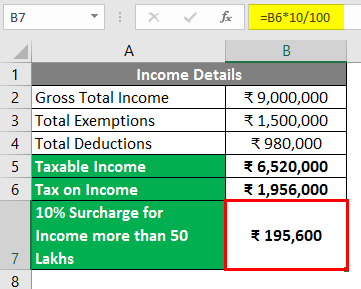

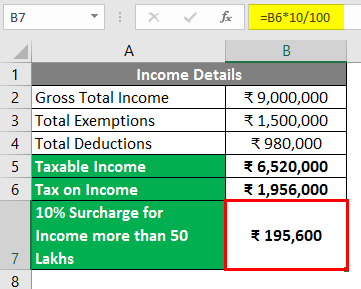

How To Calculate Income Tax In Excel

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

Singapore Income Tax Calculator Corporateguide Singapore

How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax On Salary Sale Online 59 Off Www Ingeniovirtual Com

Excel Formula Income Tax Bracket Calculation Exceljet

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Traditional Vs Roth Ira Calculator